Additional Information about Beneficiaries

You must have at least one Beneficiary.

Beneficiaries are not Responsible People (under ATF Rule 41F). That means your Beneficiaries don’t need to send any paperwork to the ATF when you buy & build Silencers & SBRs.

You can name as many Beneficiaries as you want.

Anyone can be a Beneficiary (there is no age requirement).

You can add or remove Beneficiaries as many times as you want, completely free of charge!

Additional Information about Co-Trustees

Silencers & SBRs are regulated by Title II of the Gun Control Act, which says the only person that can legally be in possession of the trust firearms is the “Responsible Person” named on the Application. However, when you have a Gun Trust, your Co-Trustees are allowed to use the Silencers & SBRs, even when you aren’t with them.

Here are some things you should know about Co-Trustees:

• You are not required to have Co-Trustees

• Co-Trustees must be at least 18 years old

• Co-Trustees are Responsible People (under ATF Rule 41F). That means every Co-Trustee is required to send fingerprints and a mugshot to the ATF every time you buy or build a Silencer or SBR.

• If you wait to add Co-Trustees until AFTER you receive your Tax Stamp (approval to buy or build a Silencer or SBR), you won’t be required to send their fingerprints and mugshots to the ATF

• We will add or remove Co-Trustees as many times as you want, completely free of charge!

• Remember: You are already the main Trustee, so don’t add yourself as a Co-Trustee.

Note: As the Trustee, you can let other people (that aren’t Co-Trustees) use the firearms, but only if you are right there with them.

Additional Information about naming your Gun Trust

Many people use a family name when naming their Gun Trust, like: “Smith Family Trust”. Or, you can use a unique name like “Lone Star Trust” or “Blackhawk Trust.”

Don’t use business entity designations such as Inc., Ltd., LLC, etc.

Enter the name of your Gun Trust exactly as you want it to appear on your documents. If you use all CAPS or all lower-case, that’s exactly what it will look like on your new Gun Trust.

Here are some examples:

You need to include the word Trust at the end of the name.

When you build an SBR or Silencer, you are required to engrave the complete name of your trust on the lower receiver or tube of the firearm. So, a longer trust name = more engraving.

Additional Information about Successor Trustees

As the person creating the trust, you are also the manager of the trust. But if something happens to you that makes it impossible for you to continue managing the trust, the Successor Trustee will take over that position.

The ATF requires you to have a Successor Trustee.

The Successor Trustee is not a Responsible Person, so you don’t have to send their fingerprints and mugshot to the ATF when you buy or build Silencers & SBRs.

Your Successor Trustee does not need to sign the trust.

If you want the Successor Trustee to be able to possess your NFA Firearms, you must also make them a Co-Trustee (which does require fingerprints and mugshot). It’s okay to have the same person listed as the Successor Trustee and as a Co-Trustee.

The ATF does not allow you to name yourself as the Successor Trustee

Additional Information about Trust Property

Anything you give to your trust is called “Trust Property”.

When you give property to your Gun Trust for the 1st time, you are “Validating” the trust. The process of validating your trust is sometimes called “Funding”

Your Gun Trust needs to be Validated (it needs to own property) before you can buy & build Silencers & SBR’s

The easiest way to give property to your trust is to give it some cash or one of your personal firearms.

If you don’t want to add property right now, you can always add something later.

If you want to add property down the road, just go to the Member’s page and click on Create an Assignment Form.

Adding property to your Gun Trust is easy, it can be done at any time, as many times as you want, and it is always completely free of charge!

Additional Information about Co-Settlors

A Co-Settlor is someone that created the trust with you and is almost always a spouse (wife or husband).

If you have a Co-Settlor, your trust might refer to them as any of the following:

Settlor or Co-Settlor

Creator or Co-Creator

Grantor or Co-Grantor

Trustor or Co-Trustor

Trustmaker or Co-Trustmaker.

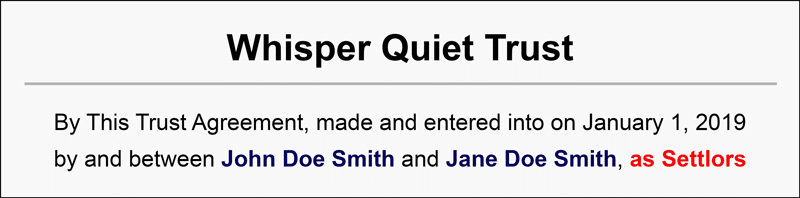

If you have a Co-Settlor, your original trust will look something like this:

Don’t get Co-Settlor mixed up with Co-Trustee

A Co-Trustee is someone that can use the firearms in your trust, but they didn’t necessarily create the trust with you.

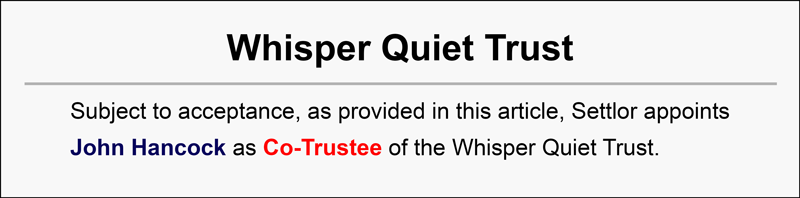

The Co-Trustee section of your original trust will say something like: